LAST YEAR WAS a brutal year for U.S. cannabis companies. The leading public stocks lost 66 percent of their value. New Cannabis Ventures’ American Cannabis Operator Index ended the year at 14.25—that’s 88 percent below its all-time high of 118.22, set what seems like a lifetime ago on April 1, 2019, just after the top multi-state operators (MSOs) went public in 2018.

That bullishness three-plus years ago now seems like the ultimate April Fool’s joke. A good part of the damage on Wall St. can be traced to the action—or inaction—of Washington policymakers. While campaigning in 2020, Joe Biden dangled the hope of federal regulatory reform, but so far hasn’t delivered it.

There’s been plenty of pain on Main Street, too. In a forecast update last September, BDSA revised downward its 2022 forecast for the U.S. industry to just 7.8 percent growth. That sounds healthy, but it represents a serious slowdown in the growth rate of what has been an exploding market. In the eight years since Washington and Colorado became the first states to legalize adult use, we estimate that the $2.5 billion medical-only legal market of 2013 exploded by 10x to what BDSA estimates was $25.1 billion in medical and adult-use spending in 2021. That remarkable run at a 33 percent compound annual growth rate (CAGR) was bound to come to an end. It turns out the COVID bump the industry enjoyed in 2020 and 2021 merely postponed the slowdown and telescoped it all into 2022.

Advertisement

But a Global Go Analytics deep dive into the growing wealth of publicly available data on the business suggests there is little threat that legal cannabis is suddenly going to become just another consumer packaged goods (CPG) market, struggling every year just to top the inflation rate by a point or two of growth. The industry’s fundamental investment thesis remains intact. In fact, it’s stronger than it’s ever been now that the hot air has been let out of the balloon that allowed the MSOs to go public at what, in retrospect, were unsustainable valuations (see By The Numbers in the Winter 2022-23 edition of Global Cannabis Times for a look at MSO valuation metrics).

Why Invest In Weed?

The investment thesis starts with the simple fact that tens of millions of Americans were spending about $50 billion on cannabis from illicit sources before adult-use legalization began in 2014. Most new industries (think organic foods in the ’70s, personal computers in the ’80s or the Internet in the ’90s) spend years educating consumers on why they would want their products. But consumers knew just what to do with legal cannabis from Day 1 of legalization.

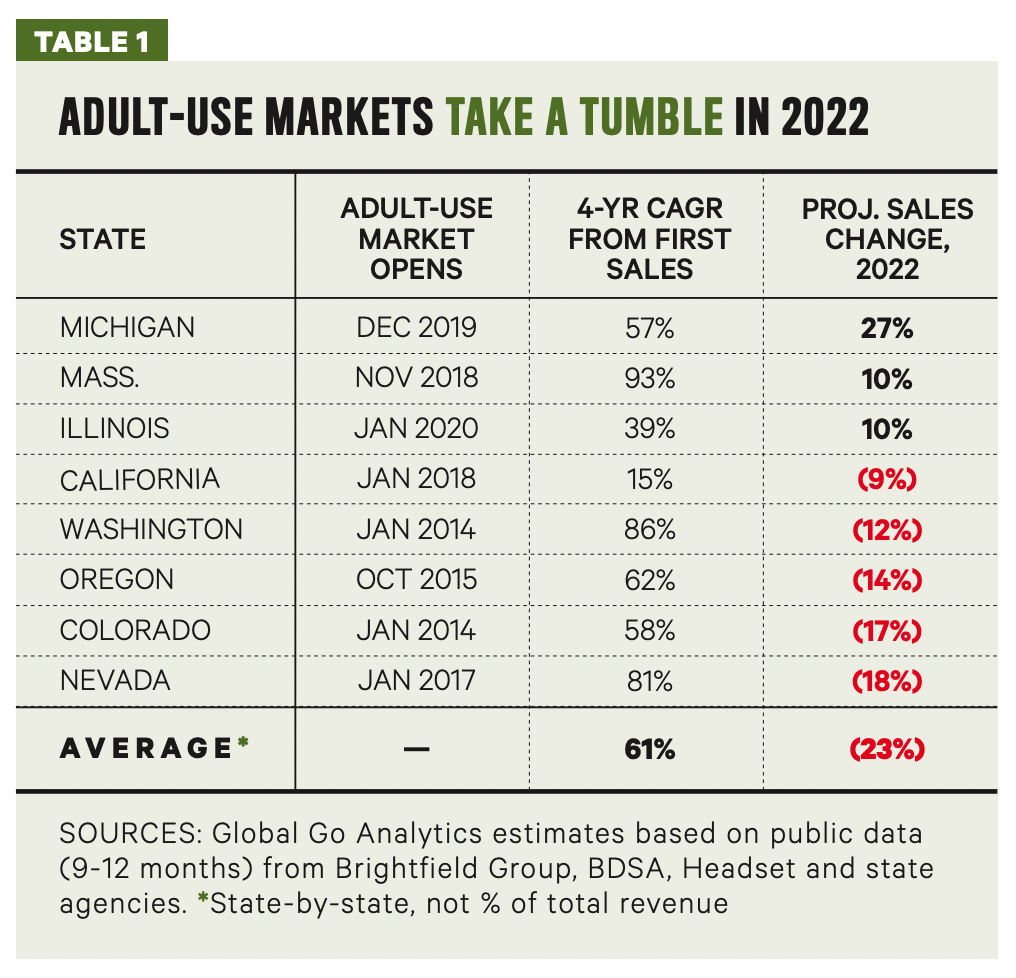

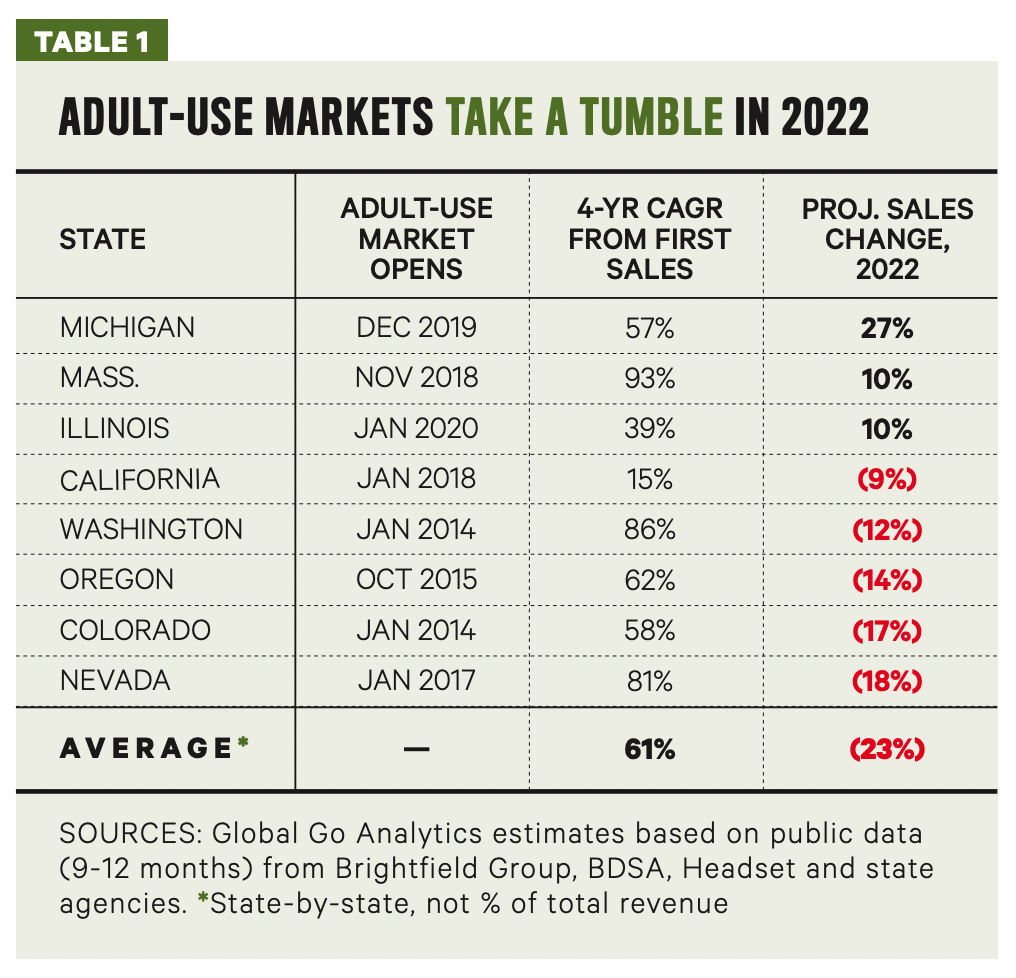

That largely explains both the industry’s eight years at a 33 percent CAGR, and the sudden deceleration of growth in 2022. For investors and strategic planners, it’s important to understand the typical pattern we’ve now seen in almost a dozen states:

Medical-only stage: Slow growth over many years to a couple hundred million in sales; only California, Florida and Pennsylvania have broken $1 billion as medical-only states.

Early adult-use stage: Expanding the consumer base from a U.S. average of less than 1 percent of the population with medical cards to the over 10 percent that report consuming monthly in government surveys has the effect you would expect: early-year CAGRs have typically been stratospheric. Witness Washington and Massachusetts—spending nearly doubled in each of their first three years of combo medical/adult sales.

Mature adult-use stage: Competition—legal, illicit and from neighboring states—drives down prices enough that spending growth slows dramatically or even goes into reverse (see table 1).

Market data & findings by Global Go Analytics

These early-year CAGRs vary based on three factors that should be taken into account in planning for future adult-use transitions:

1. How liberal were regulations in the existing medical market (practically non-existent in California, which created a booming medical market that actually contracted in 2018, the first year of adult-use sales)?

2. How restrictive were adult-use regulations (in California, local bans cut the store count by 90 percent initially and have slowed growth ever since)?

3. Did regulators continue to license new operators (not so much in Illinois, for example)?

Advertisement

Of note: high taxes are not necessarily fatal in the early years of consumer excitement (Washington launched with a 39 percent excise tax), though they can drag on legal operators once the illicit market recovers its footing.

There are also state-specific reasons behind some of the huge variances in the sobering 2022 trends. Michigan has taken a relatively liberal approach to retail availability and continues to expand, as does medical-only Florida, which also posted solid 2022 growth.

Illinois’ long hiatus on new licenses will end in 2023 but that policy put a crimp on 2022 growth, as did the much lower prices available less than an hour from Chicago in Michigan. California’s $8 billion illicit market is weathering the modest challenge mounted to its hegemony by over-taxed and over-regulated legal operators. Illicit sales in California are now actually shrinking the legal market, and likely having a negative impact on neighboring Nevada’s tourism-dependent legal trade.

The Future Is Calling

The road back to double-digit growth rates in U.S. legal cannabis is three lanes wide, with on-ramps for the following growth vehicles:

New states. When the annus horribilis of 2022 began, just 41 percent of about 25 million monthly U.S. adult consumers of cannabis—some 10.1 million total—had access to legal cannabis. About 40 percent of those were in California and they were mostly buying in the illicit market! But as more states open newly legal adult-use markets, the number of monthly U.S. consumers with access to legal product is on track to hit 16 million by the end of 2023.

New consumers. The percentage of Americans saying they had “consumed cannabis in the past month” jumped by 3.5 percentage points to 9.5 percent from 2013 to 2020, according to a Substance Abuse and Mental Health Services Administration (SAMHSA) survey. Other surveys in legal adult-use states suggest that trend accelerates with legalization, and Global Go Analytics forecasts that adult U.S. monthly consumers could number 35.2 million by 2027.

New products. Of note, the number of occasional users also grows substantially in legal states. What drives that? A proliferation of form factors, brand marketing and attractive retail environments created within legal markets surely play a big part.

Advertisement

BDSA forecasts a re-acceleration of nationwide growth rates (medical and adult-use combined) to an 11 percent CAGR through 2026, albeit with some significant caveats. This only happens if: 1. California can resume growth in 2024 after declining in both 2022 and 2023; 2. The four big northeastern states (Massachusetts, New York, New Jersey and Pennsylvania) can more than double in size to $8.8 billion in five years; and 3. If the third-largest state in the union, Florida, legalizes adult-use in 2025.

But even that acceleration could prove conservative if regulators get on board for eliminating the illicit market (and mirabile dictu, California canceled its misguided $161/pound cultivation levy in July). The math for investors—and the logic for regulators—is simple.

There are 24.6 million monthly-using adults in the U.S. and growing. Less than half had access to legal cannabis at the beginning of 2022. Where should they get their cannabis—from unregulated street dealers or from regulated retail stores and delivery services selling a cornucopia of tested, taxed and (theoretically, someday soon) reasonably priced CPG cannabis products?