Cannabis retail gets no respect: not from regulators who have tended to force it into “green zones”, nor from investors who have mostly poured money into cultivation and brands. But that’s starting to change, at least among investors who are now noticing a lot of white space on some states’ WeedMaps pages, and who have seen a lot of their supply-side bets struggle.

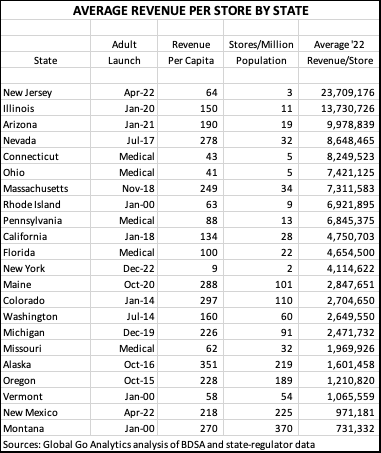

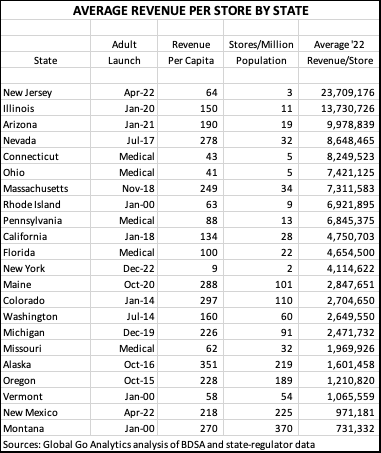

The three most important factors in retail success, says the old bromide, are “location, location and location.” That starts, in US and Canadian cannabis, with the state or province a retailer has licenses in. A study Global Go Analytics conducted last year showed that the average revenue-per-store in US states in 2022 varied enormously based on two somewhat related factors: the age of the market and the number of stores open (see table).

New Jersey just started its adult-use roll-out in April ’22; during the eight remaining months of the year an average of 25 stores served a population of 9.3 million (less than 3 stores per million people) and generated an astronomical $23.7 million each. But a market’s age isn’t everything as it would be in most retail sub-sectors: Stores that managed to get open in Illinois after its January ’20 adult-use launch benefited from the state’s glacial pace of licensing to average $13.7 million in ’22.

At the other end of the spectrum many of the pioneering states that launched adult-use sales in the previous decade, and then liberally licensed storefronts (many are now home to more than 100 stores-per-million), saw average-store revenues of less than $3 million in ‘22.

The lesson for investors: get into retail in a newly legal state early with terms that allow you to recoup your capital while revenue is off-the-charts, then clip coupons until the inevitable consolidation brings an opportunity to either exit or become the consolidator.

Why Retail, Why Now?

“We’re focusing on retail in our third fund,” veteran cannabis investor Morgan Paxhia of Poseidon Asset Management told the Chicago Benzinga conference last September. “We think access to the product is what will be important going forward, rather than supply which is overbuilt.” Poseidon is not alone: “We’re seeing a huge appetite for retail from our investors,” confirmed advisor David Kram of Spring Leaf Capital.

Perhaps nobody has participated in the whole arc of cannabis investment strategies longer than Paxhia, who celebrated the 10th anniversary of Poseidon’s Fund One in January and sat down with me February 22 to discuss why Poseidon’s focus is shifting to retail.

Fund One’s initial focus was on capitalizing on public stocks and “we generated some really big returns right out the gate, which broadened into a much bigger and diversified fund that still runs today,” Paxhia said.

Fund Two, launched in September 2018, focused on private companies, investing in a mix of technology, cultivation, brand, and verticals. Poseidon was an early backer of what turned out to be some of the top names in the cannabis business: Ascend, GTI, Flowhub, Pax, wurk, and California retailer/grower sparc.

The importance of location goes deeper than the state level, Paxhia said. “It’s really jurisdiction. We’re not interested in retail if it’s the 15th store in a saturated jurisdiction. You can’t make money in retail if you’re only doing $2-$5 million in California. So naturally, we are looking for Eastern markets, new markets, like New Jersey, Pennsylvania, Ohio, even Massachusetts.

“We’re even looking at New York now which obviously has a long, long way to go for scaling up its retail. Some of the doors that are open are doing, we’re hearing, $25 million a year, some top-end doors $70 million. The idea is we want to get the return while the numbers are so inflated. We also think consolidation is a theme that will continue for a very long time. There’s going to be a lot of M&A happening because the larger footprints are going to want good retail in good jurisdictions.”

Fitting the Strategy to the Market

At the other end of the population-density spectrum from New York, the same thinking has driven the strategy of Canada’s Cannabis Xpress chain, which has 14 stores in small towns in Ontario and two (with a third this year) in sparsely populated (831,618) New Brunswick. Founder president Chris Jones ticked off the advantages of small-town retailing in a recent conversation:

- Strong Brand Recognition: As the sole provider of cannabis products in the area, the store becomes synonymous with cannabis consumption within the community.

- Reduced Operational Costs: Without the need to invest in aggressive marketing strategies or engage in price wars, the store can focus on optimizing operational efficiency and reducing costs.

- Opportunity for Expansion: Being the exclusive provider in a town can serve as a solid foundation for future expansion into adjacent markets.

- Monopoly Advantage: Being the exclusive cannabis retail store in a town grants a monopoly advantage, allowing the business to capture the entire local market share without direct competition.

Jones lives in Toronto, but said, “I would rather be the only one in a small town than to compete with many people on the same street in Toronto.” The economics of small-town stores are, of course, radically different from either the first-movers in New York with eight-figure revenue run-rates, or Paxhia’s California example losing money on revenue in the $2-$5-million range. The 16 Cannabis Xpress stores did just $6.7 million revenue in ’23. But they cost less than $100,000 each to open.

Now Jones is looking to capitalize on Paxhia’s exit-strategy theory about bigger companies wanting to gobble up “good retail in good jurisdictions.”

“The plan was to build and scale the business and sell it, which is where I am at with it right now. The goal was always to build it and sell it, that is what my investors also understood. Since we are profitable, there is no rush for me to sell it – I will continue to grow the business until the right offer comes in.”

Right there is the upside of focusing on good retail locations: profits or pay-off, and the freedom to decide for yourself which to take.

TOM ADAMS is the CEO of Global Go Analytics. As founder of Adams Media Research and Adams Cannabis Research, as well as former head of Industry Intelligence at BDSA, Tom is unrivaled as an industry analyst and strategic consultant in legal cannabis. He can be reached at tadams@globalgo.consulting.

TOM ADAMS is the CEO of Global Go Analytics. As founder of Adams Media Research and Adams Cannabis Research, as well as former head of Industry Intelligence at BDSA, Tom is unrivaled as an industry analyst and strategic consultant in legal cannabis. He can be reached at tadams@globalgo.consulting.

The three most important factors in retail success, says the old bromide, are “location, location and location.”

The three most important factors in retail success, says the old bromide, are “location, location and location.”

Cover Features11 months ago

Cover Features11 months ago

Cover Features11 months ago

Cover Features11 months ago

Legal9 months ago

Legal9 months ago

Branding10 months ago

Branding10 months ago

Products9 months ago

Products9 months ago

Business12 months ago

Business12 months ago

Branding12 months ago

Branding12 months ago

Podcasts11 months ago

Podcasts11 months ago

TOM ADAMS is the CEO of

TOM ADAMS is the CEO of