IT’S LITTLE WONDER that market-share for even the largest house of brands in cannabis is measured in single digits—there were more than 3,000 brands on the shelves of America’s 10,000-plus cannabis stores in 2022. Nevertheless, leaders are starting to emerge in the battle for national preeminence.

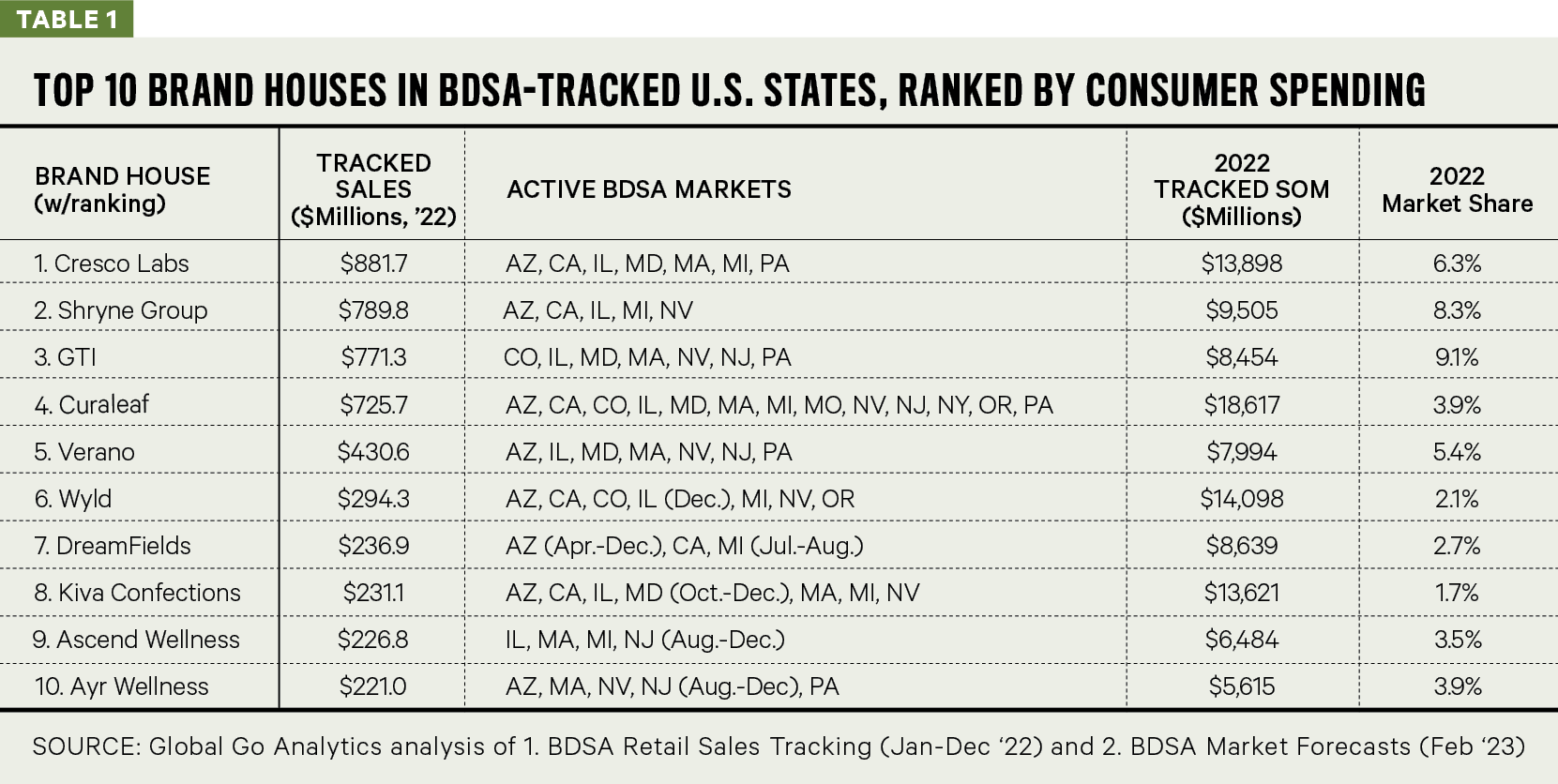

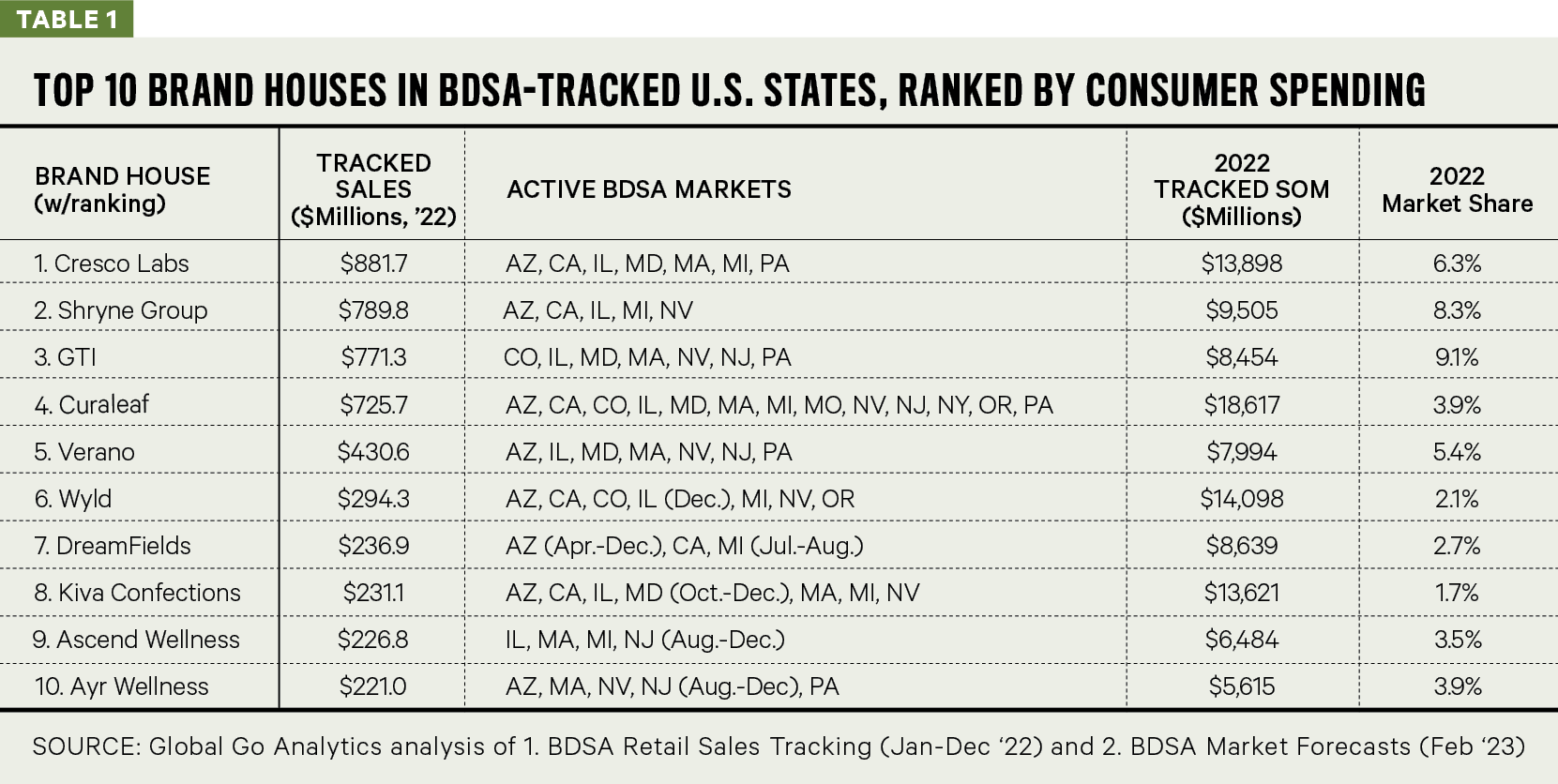

We now have BDSA’s Top 10 cannabis brands by select-state retail sales in calendar year 2022 (see Table 1). A deep dive by Global Go Analytics into BDSA’s Retail Sales Tracking of point-of-sale (POS) data across 14 states shows that leaders at this early stage of the industry are of two types:

- Multi-state operators (MSOs)with their own retail sales outlets and wholesale distribution to other stores

- Pure-play brand companies selling at wholesale, often through partnerships outside their home states MSOs and pure-play brands have pursued very different strategies to achieve Top 10 status. What they have in common is that in the rigidly regulated, state-by-state structure of legal cannabis, they have all departed substantially from the brand-building playbook at mainstream consumer packaged goods (CPG) companies.

In fact, it can honestly be said there are not yet any national brands in cannabis in the traditional sense. Even the largest of brand houses sell their products in half or less of the 40 legal U.S. markets. None have Super Bowl ads, or any broadcast ads at all. None ship their products nationally from efficient centralized production facilities. Celebrity tie-ins are rare among the Top 10.

Cannabis brand marketing operates in a world of its own.

Benchmarking Success

The fair measure of success in these early days of legal cannabis is not sales as a percentage of legal cannabis’ Total Addressable Market (TAM), whether that TAM is the world market that BDSA estimates at $32.1 billion in 2022 or the $26.1-billion U.S. market. Against those broadest possible market definitions, these companies have tiny shares indeed: 3 percent for the largest of the BDSA Top 10, less than 1 percent for the smallest.

The fairest way to compare market shares is to look at the percentage of consumer spending each company is capturing in the states in which it has sales and in which BDSA tracks POS activity—each company’s “tracked Serviceable Obtainable Market (SOM).” BDSA tracks SKU-level data in most major markets (all but Florida and Washington of the nine $1-billion-plus states in 2022). Hence our market-share estimates based on BDSA tracking are likely very close to these companies’ actual share of their total SOMs.

Cresco Labs was the largest retail revenue generator among the nearly 250 brand houses tracked by BDSA last year. Cresco’s brands attracted $882 million in consumer spending in 2022 in the seven states BDSA tracked (out of the 10 in which Cresco operated). That amounts to a market share of 6.3 percent of the $13.9 billion in total spending in Arizona, California, Illinois, Maryland, Massachusetts, Michigan and Pennsylvania.

Though their overall retail sales were smaller than Cresco’s, both GTI and Shryne Group captured a bigger share of spending in their respective markets. GTI captured 9.1 percent of the $8.4 billion spent on legal cannabis in seven states. Shryne rode its Stiiizy vape juggernaut to an 8.3 percent share of the $9.5-billion combined markets of Arizona, California, Michigan and Nevada.

Curaleaf has by far the biggest total SOM of any house of brands in this Top 10—$22.1 billion in 20 states where it distributes its brands. BDSA tracks POS data in 13 Curaleaf states with a SOM of $18.6 billion (84 percent of Curaleaf’s total SOM). In those 13 states, Curaleaf brands captured $725.7 million in sales, for a tracked market share of 3.9 percent.

Advertisement

Market Factors Driving the Data

It’s not just the number of competitors that has limited individual brand-house share, but the industry’s unique history and current structure.

The roots of the business are in the illicit market of the late-20th century, in which cannabis purveyors—far from marketing themselves openly—guarded their anonymity. Flower strains were the marketing hook, one reason retail “house brands” are more prevalent than in other CPG sectors, especially in the flower category. To protect the anonymity of its panel, these “in-house-only products” are not included in BDSA’s tally of brand-house revenue.

But playing the key role in limiting brand-house share is the ongoing Balkanized structure of today’s medical and adult-use markets, in which a hodgepodge of state regulatory regimes prompted two very different approaches to brand expansion.

The privately held companies in the Top 10 (Shryne, Wyld, DreamFields, and Kiva) come out of western states like California and Oregon which saw the emergence of the first branded cannabis products almost a decade ago. Early market leaders of the 2017-18 era began to develop innovative licensing deal structures. These allowed them to expand their brands to other states, often by partnering with companies in target states that held licenses to provide the required raw materials, manufacturing and physical distribution networks. This kept expansion costs low for these privately held companies.

During that same timeframe, the first MSOs emerged as newly legalizing states loosened restrictions on out-of-state ownership. Six MSOs are in BDSA’s Top 10 Brand House ranking (Cresco, GTI, Curaleaf, Verano, Ayr and Ascend). All sell a variety of their own brands in their own stores while pursuing wholesales sales to other retailers to varying degrees.

Advertisement

The Next Stage of Brands

The challenge for brand-builders going forward will be taking advantage of the “extinction event” being triggered by the industry’s dramatic deacceleration and the likely reduction in competition. After eight years (2013-21) of booming along at a 34 percent CAGR, price compression has slammed on the brakes: BDSA estimates the U.S. market grew at just 2 percent in 2022.

During the boom years, the public MSOs had plenty of cash for organic growth, and shares that traded well above the multiples they were paying to buy market share through M&A. Now with their market capitalizations under extreme pressure, they are focused on getting profitable within their existing footprints. Expansion to new states has been on hold for most MSOs.

The privately held brand houses had to move more slowly in the go-go era. But they largely stayed out of cultivation and retail, the two most capital-intensive activities in the business. That leaves them—and many other smaller pure-plays who don’t show up in today’s Top 10—more free than the MSOs to plow cash into new opportunities in new states.

Still, the MSOs have an overall size advantage. As we saw in the Global Cannabis 50 ranking in the Winter 2022-23 edition of Global Cannabis Times, nine MSOs rank among the Top 10 largest public companies in cannabis. The largest MSOs have SOMs that typically amount to 80 percent-plus of the national market, and thus don’t really need to enter new markets to continue to build up their brand equity with the national consumer base.

The battle of the brands has been joined, but it is very early days. Since federal legalization keeps receding into the future, these combatants will be operating in today’s multi-state, “fog of war” conditions for some time to come. We’ll be taking a detailed look at their strategies in a cover story in the next Global Cannabis Times.

Cover Features11 months ago

Cover Features11 months ago

Cover Features11 months ago

Cover Features11 months ago

Legal9 months ago

Legal9 months ago

Branding10 months ago

Branding10 months ago

Products9 months ago

Products9 months ago

Branding12 months ago

Branding12 months ago

Business12 months ago

Business12 months ago

Podcasts11 months ago

Podcasts11 months ago