Leading investors at the recent Benzinga Capital Conference in Chicago pointed hopefully to three recent pieces of news: AG Merrick Garland’s statement to the Senate Judiciary Committee that federal prosecutors will continue to respect state cannabis laws, the recommendation from the federal Health and Human Services Department that the DEA reschedule cannabis from Schedule 1 to Schedule 3, and the approval of the SAFER banking act by the Senate Banking Committee.

The viability of each of these measures will depend on the degree of support they are able to garner from the Biden Administration, whose cannabis policy thus far can be most generously described as one of benign neglect. But let’s assume for now that the investors’ most closely held hopes really do come true, and ask ourselves how the cannabis market might change if all three of these initiatives were realized. What difference would it make in our world?

The licensed and regulated cannabis sector would benefit in several ways:

Rescheduling would lift the burden of 280(e), bringing immediate and substantial improvement to the income statements and balance sheets of most licensed cannabis companies, and taking some of them into profitability for the first time. SAFER will enable cannabis retailers to accept credit and debit cards, and decrease the risk of loss or injury from robberies and burglaries. Both measures will increase sales and access to credit, capital, and financial services industry-wide. They will reduce stigma, accelerate state-level reforms, and if Merrick Garland really respects state cannabis laws, may open the door to interstate commerce. Valuations for all companies, and trading prices for most publicly traded entities would soar. The legal, corporate sector of the cannabis world would receive many of the benefits of federal legalization without the burdens of federal regulation.

But none of these measures would do anything to the core of the economic crisis in cannabis today: the competitive imbalance between legal, regulated cannabis companies and the unregulated, legacy sector of the market. In most US cannabis markets, weed in licensed shops costs twice as much as on the unregulated market and is half the quality. In many places, only consumers who are unable to access the widespread unregulated market are willing to pay those prices— so the legal market is still just a small fraction of the overall market.

Overtaxation and over-regulation have made legal cannabis uncompetitive, and forced the most talented and dedicated cannabis professionals back into the underground market— where they continue to thrive, as they have for the past 50 years. No amount of new credit, capital, or financial services will alter that dynamic.

Advertisement

The real solution to the crisis besetting cannabis is the creation of a single, unified legal market capable of attracting all or at least most consumers and producers. In order to accomplish that goal, reforms at the corporate end of the market need to be mirrored at the small scale sector, to create a structure and incentives that will encourage the army of phenomenally talented legacy cultivators, distributors, and retailers to move into the legal market. And bring their consumers with them.

In order to fully realize the potential of this moment, large corporate cannabis entities should form an alliance with this legacy army to drive down the tax and regulatory burden for everybody, and make sure those burdens are shared by all sectors of the industry— to create a level and achievable playing field for the entire cannabis industry, legacy and legal.

To be effective, those reforms should facilitate the strategies that have made legacy operators so resilient, and take down the barriers that keep them out of the legal side of the industry. These steps should include immunity from prosecution for their activities during Prohibition, along with an ability to bring the financial resources they built during that period into new legal businesses.

Licenses for small grows of up to 5000 or maybe 10000 square feet should be made readily available, at low cost, to almost anybody who wants one— and they should not be burdened with unnecessary and expensive regulatory requirements.

The small growers should be empowered to sell directly to consumers (as they have for years on the underground market), at the kind of brick and mortar farmer’s markets that are happening in New York, and at online marketplaces. Imagine an Etsy for Weed, where consumers could browse the selections of hundreds of growers, order and pay online, and have their cannabis delivered by FedEx or UPS, like any other legal product.

Small craft growers would maximize their upside by selling directly to consumers; consumers would maximize the value of their purchase by buying directly from the grower. Quality would be higher because the crops would receive more personal attention, and the short supply chain will reduce distribution costs and ensure freshness.

Advertisement

The whole industry would win. Legacy growers could come in from the cold; reduce their risks, and get some of the benefits of a legal income like mortgages and insurance policies. Public health and revenue would improve as the cannabis they sell would finally be tested and taxed. Consumers would have a wider range of choice, and most likely much better cannabis at a lower price— and regulators would be freed from the expensive task of identifying and closing down unlicensed retailersEven the large corporate players could win, providing financing and infrastructure to the small growers; building the brick and mortar and online farmer’s markets; providing compliance, marketing, recruiting, payroll and other services; and opening high profile and widely distributed retail outlets that will provide consumers with a visibility and convenience unlikely to be matched by the small craft sector.

As we approach the 2024 elections, political pressure may finally push the Biden Administration to back significant federal cannabis reform. Those reforms at the top level of the legal cannabis pyramid might be sufficient to jumpstart investor enthusiasm and generate many millions of fresh dollars for new expansion, but to what end? All that money will just be poured down the same uncompetitive hole, with the same investor losses, if there is no change to the market fundamentals that are driving the crisis.

The bull market for cannabis won’t return until the majority of cannabis consumers currently sitting out licensed cannabis are drawn into it; and a single, unified market is created; with reasonable taxes and realistic regulations for all players in the space.

The cannabis plant teaches valuable lessons to those who listen to her. One of those lessons is to share; another of those lessons is to think out of the box. Let’s take both of those lessons to heart; let’s engage our collective brilliance; bridge our differences, and finally realize our full potential— to create not just a new industry, but a new kind of industry.

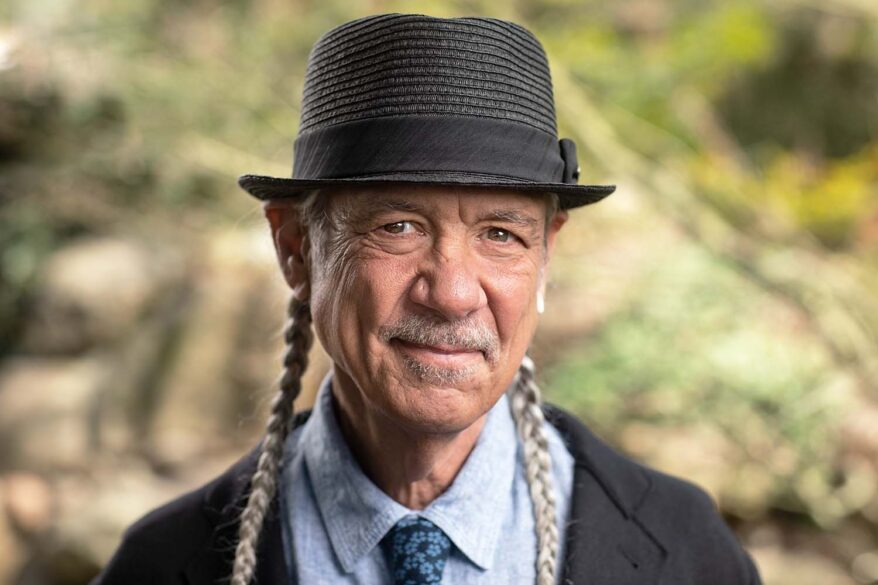

Steve DeAngelo is one of the original cannabis pioneers, and is known widely as the Father of Legal Cannabis. He spent the past year helping Rastafari Indigenous Village; in Montego Bay, Jamaica; build an on-site center for visionary plant retreats: rastavillage.com

Advertisement

Advertisement

“The cannabis plant teaches valuable lessons to those who listen to her.” PHOTO COURTESY STEVE DEANGELO

“The cannabis plant teaches valuable lessons to those who listen to her.” PHOTO COURTESY STEVE DEANGELO