11 INNOVATIVE INDUSTRIAL PROPERTIES

TTM REVENUE: $248 million

TICKER: NYSE: IIPR

HQ: San Diego, CA

IPO Date: 11/28/16

IPO Price: $18.45

Recent Price: $112.28

Market Cap: $3.01 billion

Innovative Industrial Properties is a U.S.-based real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators. It is the highest-ranking NPTE in the Global Cannabis 50.

12 TILRAY BRANDS

TTM REVENUE: $243 million

TICKER: NASDAQ: TLRY

HQ: Nanaimo, BC, Canada

IPO Date: 7/16/18

IPO Price: $29.77

Recent Price: $3.81

Market Cap: $2.03 billion

Tilray Brands is a Canadian LP with operations in Canada, the U.S., Europe, Australia and Latin America. Tilray’s production platform supports more than 20 cannabis brands in more than 20 countries.

13 ACREAGE HOLDINGS

TTM REVENUE: $225 million

Ticker: OTC: ACRHF

HQ: NYC, NY

IPO Date: 9/28/20

IPO Price: $2.90

Recent Price: $1.01

Market Cap: $80 million

Acreage Holdings is a vertically integrated MSO operating 27 dispensaries in 10 U.S. states. Acreage brands include The Botanist and Superflux.

Advertisement

Acreage

14 WM TECHNOLOGY

TTM REVENUE: $221 million

TICKER: NASDAQ: MAPS

HQ: Irvine, CA

IPO Date: 9/30/19

IPO Price: $9.81

Recent Price: $1.83

Market Cap: $339 million

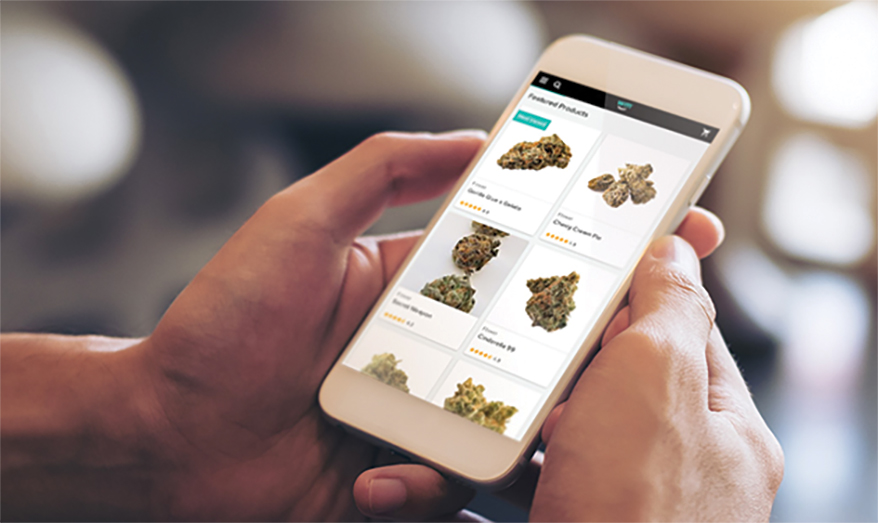

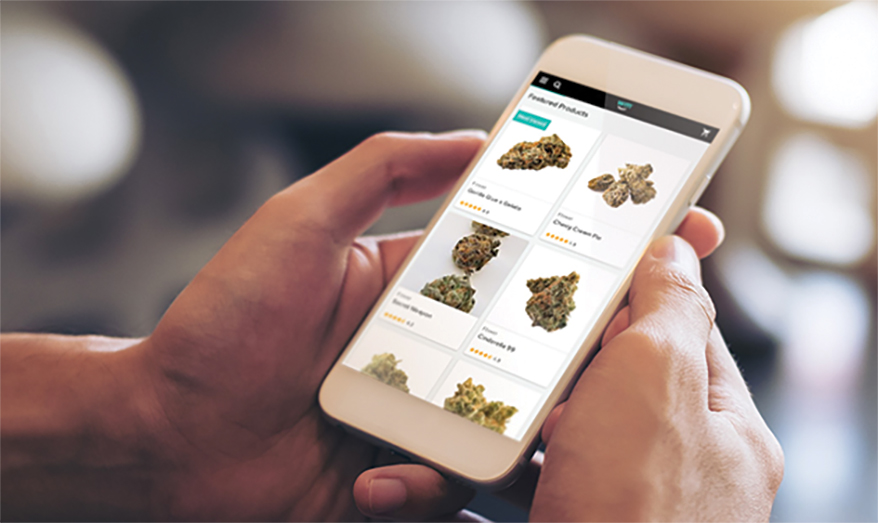

WM Technology is a leading U.S.-based technology and software provider to the cannabis industry. The company’s flagship product is WeedMaps.

WeedMaps

15 HIGH TIDE

TTM REVENUE: $220 million

TICKER: NASDAQ: HITI

HQ: Calgary, AB, Canada

IPO Date: 1/8/21

IPO Price: $3.19

Recent Price: $1.36

Market Cap: $96 million

High Tide is a Canadian retailer operating stores across Canada, including its discount club brand Canna Cabana. High Tide is the highest-ranked retail-only company in the Global Cannabis 50.

16 TERRASCEND

TTM REVENUE: $213 million

Ticker: OTC: TRSSF

HQ: Mississauga, ON, Canada

IPO Date: 11/13/17

IPO Price: $1.56

Recent Price: $1.59

Market Cap: $468 million

TerrAscend is a vertically integrated Canadian LP and U.S. MSO. TerrAscend operates The Apothecarium and Gage retail outlets.

17 TILT HOLDINGS

TTM REVENUE: $197 million

Ticker: OTC: TLLTF

HQ: Boston, MA

IPO Date: 1/8/21

IPO Price: $0.43

Recent Price: $0.10

Market Cap: $34 million

Tilt Holdings is a vertically integrated MSO and developer of vape technology. Tilt’s brands include Commonwealth, Jupiter and Standard Farms.

18 GREENLANEHOLDINGS

TTM REVENUE: $184 million

TICKER: NASDAQ: GNLN

HQ: Boca Raton, FL

IPO Date: 4/15/19

IPO Price: $422.00

Recent Price: $0.45

Market Cap: $7 million

Greenlane is a global platform for the distribution of premium cannabis accessories, packaging, vape solutions and lifestyle products. Greenlane distributes products through 8,000 retail locations, including licensed cannabis dispensaries, smoke shops and specialty retailers. blah blah blah blah blah blah blah blah blah

19 IANTHUS CAPITAL HOLDINGS

TTM REVENUE: $183 million

Ticker: OTC: ITHUF

HQ: NYC, NY

IPO Date: 2/26/18

IPO Price: $2.79

Recent Price: $0.04

Market Cap: $269 million

iAnthus Capital Holdings is a vertically integrated MSO with operations in 11 U.S. states. Top iAnthus brands include The Makery and Anthologie.

20 AURORA CANNABIS

TTM REVENUE: $164 million

TICKER: NASDAQ: ACB

HQ: Edmonton, AB, Canada

IPO Date: 7/11/14

IPO Price: $10.70

Recent Price: $1.31

Market Cap: $394 million

Aurora is a vertically integrated Canadian LP serving both the medical and consumer markets in Canada. Aurora’s brand portfolio includes Aurora Drift, Reliva and MedReleaf.

21 MEDMEN ENTERPRISES

TTM REVENUE: $147 million

Ticker: OTC: MMNFF

HQ: Culver City, CA

IPO Date: 6/1/18

IPO Price: $3.29

Recent Price: $0.04

Market Cap: $47 million

MedMen is an MSO specializing in retail with operations in six U.S. states. MedMen’s top product brands are MedMen and LuxLyte. The company also runs MedMen Buds, a customer loyalty program.

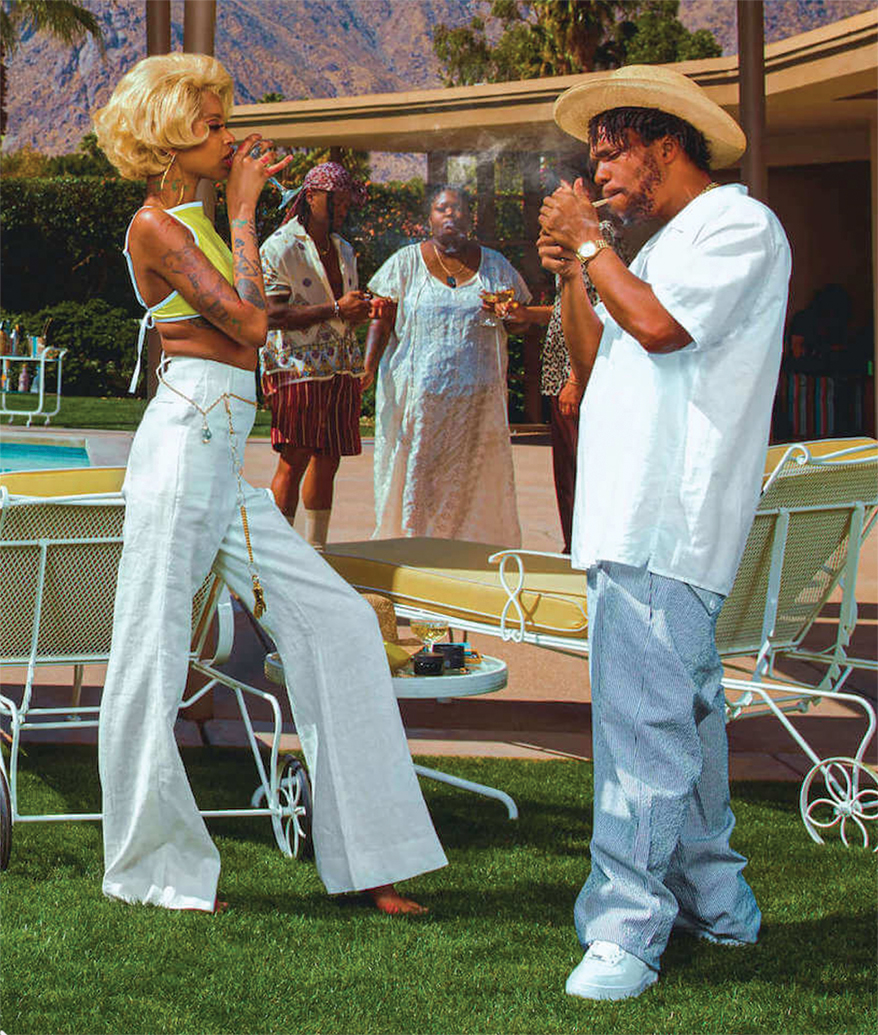

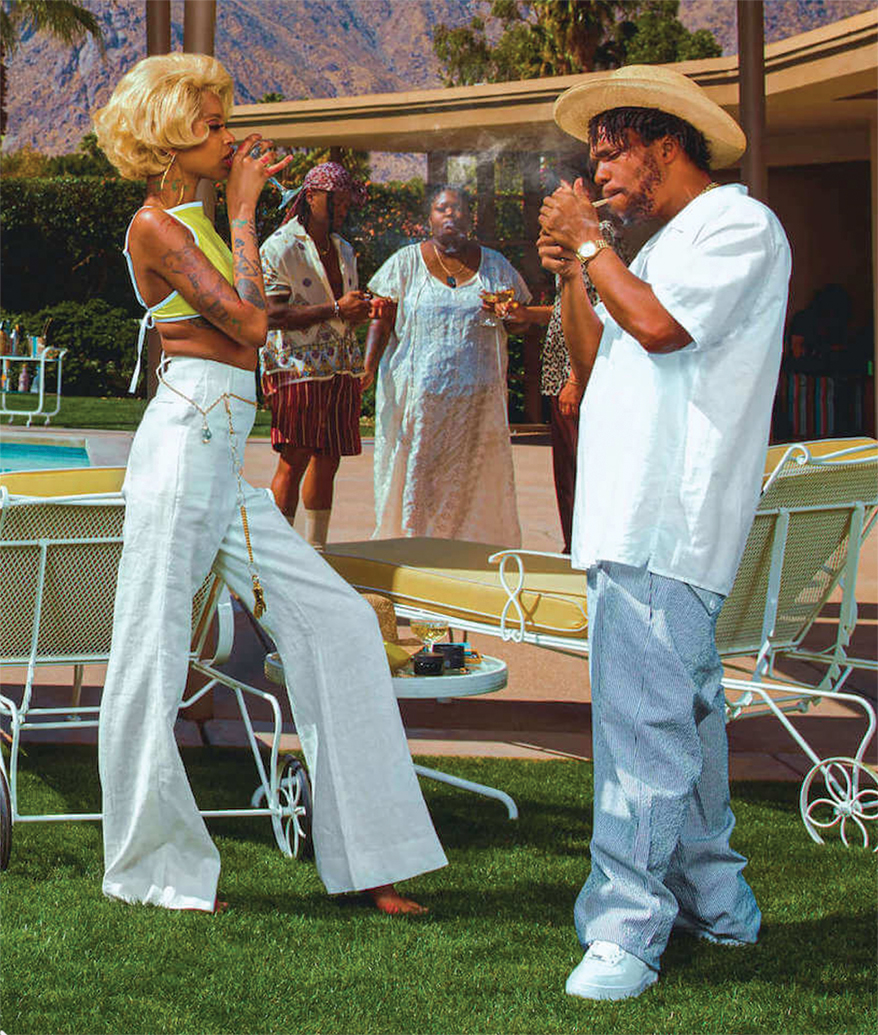

Advertisement

The Parent Company

22 THE PARENT COMPANY

TTM REVENUE: $143 million

Ticker: OTC: GRAMF

HQ: San Jose, CA

IPO Date: 9/24/20

IPO Price: $9.91

Recent Price: $0.34

Market Cap: $34 million

The Parent Company is a vertically integrated SSO operating in California. Top brands include Monogram by Jay-Z, Caliva and Fun Uncle. The Parent Company is the highest ranking SSO in the Global Cannabis 50.

23 NOVA CANNABIS

TTM REVENUE: $142 million

TICKER: TSX: NOVC

HQ: Calgary, AB, Canada

IPO Date: 10/31/08

IPO Price: $6.91

Recent Price: $0.50

Market Cap: $29 million

Nova Cannabis is a Canadian retail operator. Nova’s primary brand is the Value Buds chain of stores offering cannabis products at discounted price points.

24 SCHWAZZE

TTM REVENUE: $134 million

Ticker: OTC: SHWZ

HQ: Denver, CO

IPO Date: 6/17/16

IPO Price: $1.65

Recent Price: $1.24

Market Cap: $68 million

Schwazze is a vertically integrated MSO specializing in retail and brand development with operations in Colorado and New Mexico. Schwazze retail outlets include Star Buds, Emerald Fields and R. Greenleaf.

25 HEXO

TTM REVENUE: $133 million

TICKER: NASDAQ: HEXO

HQ: Ottawa, ON, Canada

IPO Date: 3/24/17

IPO Price: $5.93

Recent Price: $0.18

Market Cap: $108 million

HEXO is a Canadian LP serving Canada’s medical and recreational cannabis markets. Company brands include Redecan and UP.

Cover Features11 months ago

Cover Features11 months ago

Cover Features11 months ago

Cover Features11 months ago

Legal9 months ago

Legal9 months ago

Branding10 months ago

Branding10 months ago

Products9 months ago

Products9 months ago

Business12 months ago

Business12 months ago

Branding12 months ago

Branding12 months ago

Podcasts11 months ago

Podcasts11 months ago