Published

2 years agoon

JIM CACIOPPO isn’t afraid to run counter to conventional wisdom. When he brought the team together that would found Jushi Holdings in 2018, Cacioppo was advised to stick to high-profile states like New York and Florida for cannabis retail.

Instead, Jushi chose to target overlooked markets in states like Virginia and Pennsylvania. Over the next few years, Caccioppi and his team methodically acquired dispensary licenses and integrated grower-processor operations into a profitable, vertically integrated chain of cannabis retail outlets spread across five U.S. states.

Jushi’s return on its investments has been impressive. The publicly traded company’s most recent earnings were boffo—Jushi reported $54 million in sales for Q3 2021, an increase of 13.1 percent quarter-over-quarter, 116.7 percent year-over-year and a 15X leap in revenues from just two years ago.

Cacioppo says the secret to Jushi’s success has been threefold: picking the right markets to operate in, managing risk intelligently and good management practices he learned from his years running hedge funds. Global Cannabis Times recently caught up with Jushi’s founder, chairman and CEO to learn more.

About the interviewer: Tom Zuber is the Managing Partner of the law firm Zuber Lawler, which has been representing leading plant medicine companies for over 15 years.

TOM ZUBER: Jim, thank you for having me here. We’d like to get to know the man that runs Jushi. So let’s start with the basics. Where did you grow up?

AdvertisementJIM CACIOPPO: I was born in the Bahamas. I moved to South Florida when I was nine years old and I was here [in South Florida] until I was 18. And then I went to school in New York and stayed in New York for 30 years.

You went to college at Colgate followed by Harvard Business School, with a few years in between, as is common. What did you do during the years in between Colgate and Harvard?

I worked for a Fortune 100 company called Dun & Bradstreet Corporation, which is a conglomerate of information businesses, and then I left there for business school.

What was your first gig out of business school?

I went into investment banking, I was intent to get on Wall Street. I was an associate at Smith Barney, Harris Upham & Co., which was a white shoe investment bank at the time, sort of mid-market.

With a background in hedge funds, how did you end up in the cannabis industry? What inspired you to start Jushi?

AdvertisementSo what happened was, around 2012, 2014, I slowed down the hedge fund thing quite dramatically, kind of kicking clients out and not taking any more money. I moved back to Florida in 2014 with the intent of sort of slowing down and kind of taking stock and getting out of the hedge fund business. In 2015, I discovered cannabis from an investment standpoint. I invested in about 25 different companies between that time and when I started Jushi.

And I used [cannabis] starting in college. I think it’s a great product. Prohibition, I thought, was ridiculous, and I still do. So I believe in a lot of social issues around it in terms of people being unfairly prosecuted or put in jail. [Cannabis] has much more of a medicinal quality than alcohol, as an example. I thought it was a slam dunk [that cannabis was] going legal. And I thought the best way to play it as a business venture was through investment in multi-state operators.

But this was back in 2017. There wasn’t a lot to choose from in the public markets. The companies that went public back then are now bankrupt. And so I decided to start my own. I said, this is a great opportunity but I can’t invest in [cannabis] in a big way. Why don’t I just start a company? So that’s how it started.

How do you go about starting a Jushi coming in from a hedge fund background? You’ve smoked it recreationally, but I assume you’re not as experienced in the actual production of cannabis …

Right. Yeah. So I got into the hedge fund industry in 1995. I had a very long career, right? And one of my specialties was distressed debt. And the other thing is, I started two big hedge funds. One was $300 million when I got there, $5.5 billion when I left. And the other was was zero and became $2.3 billion very quickly. So I had two startups where I managed the business. I already had built businesses. When I left Sandell [Asset Management], which was the big one that went to $5.5 billion, it was generating tons of revenue, had three offices, employed 150 people and was very profitable. I was president, a co-portfolio manager, I was one of two partners. I ran the distressed debt portfolio and I ran the whole firm. So the back office, the CFO, operations, they all reported to me.

AdvertisementSecondly, in distressed debt, you become a private equity sponsor, because these companies aren’t performing and they need to. They are over-leveraged, so often you buy the debt and it gets turned into equity. When that happens, you take control. And after a few years of this, I realized that the best people to go on the boards [of these over-leveraged companies] were me or my employees.

When you’re going on the board of a distressed company that has lost its management team, you’re having meetings every few weeks, two weeks, even weekly. You kind of end up running the company for a good six to 12 months until you bring in a strong management team. So I felt like I had multiple touches on running several businesses … billion dollar companies, ultimately, when we turned them around and we sold them. In one case, a chemical company, there was a bidding war between two private equity firms that was close to a billion dollar deal.

Another one was a casino company, which is a highly regulated business. I was checked out by the FBI and all these different things that the casino regulators look at. It was across four or five states or maybe even more, I forget. We sold it a couple years later for a nice profit. It was about a $700 or $800 million business when we sold it. So I feel like I had these touches of really getting very active in businesses and one of them was a highly regulated business. That prepared me for thinking about starting a cannabis company.

That’s very interesting. I have to tell you, we’ve been in the industry since 2006. And we’ve seen folks come in from outside the cannabis industry and start companies that fail despite many of the stakeholders having successful backgrounds outside of cannabis. Because cannabis is funky. It’s just weird. In a wonderful way and a very, very extreme way. How did you get your mind around the weirdness of cannabis? Did you bring in folks who actually ran cannabis businesses? Was that priority No. 1? How did you make that transition?

I would point out that a lot of [financial] people who start businesses and fail have seemingly good backgrounds. Like very good marketing achievements or they might have been at a great institution like Goldman Sachs, or wherever. But they weren’t that senior. They never really ran anything. They were just another banker. A lot of people can promote themselves, promote an idea, promote a new company. They’re promoters. Part of that is saying, “Hey, I worked at this great firm!” Let’s call it Goldman Sachs, everybody knows they’re great. But a lot of people work at a prime brokerage who aren’t partners. If you’re a director level at Goldman Sachs that doesn’t mean you’re necessarily equipped to go run a company in a very difficult, entrepreneurial, highly regulated business like cannabis. We can call those people “pretenders.”

I think the washout that you’ve seen among companies that have actually gone public since 2019, it shows there were a lot of pretenders. There are still some companies that are washing out. Now I think we’re seeing the strong [companies] rise to the top. There are about 10 investable companies [in cannabis] and we’re one of them.

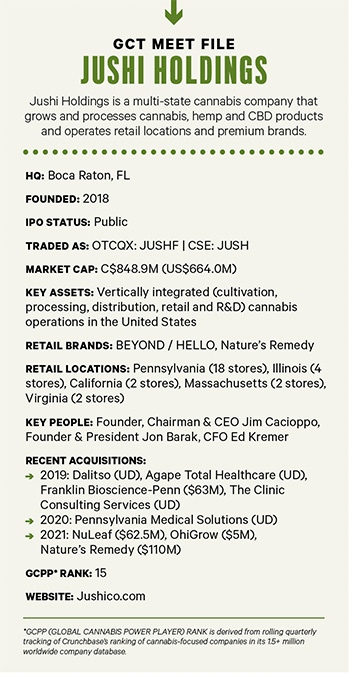

To the second part of your question, as we formed the company, we went through different stages of how we brought people in. When we first started the company, we were an acquisition-business development company. So it was really about building a legal team and a banking-investment team. We had people who could go source the deals. We also brought in an operating team to help us do due diligence and then run the businesses we acquired. [Ed. note: See GCT Meet File on previous page for a list of Jushi’s major acquisitions.]

The first people were the deal people. The operating people were more cannabis people. They understood the product. They understood the important aspects of the product. And over time, as we bought and built out licenses, we brought on corporate-level management, really high-quality operational people who have run big businesses, run big plants. Along with that it was about building out some of the functions like HR and then bringing in the senior managers who had done this kind of managerial work on a large scale in different industries.

Advertisement

Tom Zuber, left, and Jim Cacioppo drill down to the details at Jushi’s Boca Raton, FL offices. PHOTO CREDIT: LAUREN BRITZ

I get the impression that the distressed quality of the companies that you managed in your finance career played a key role in your suitability to take the reins at a cannabis company.

Well, yeah. I always used to say the [cannabis] industry is distressed, but it doesn’t know it. And it’s not really the industry itself, but the individual assets back in 2017, 18, 19, when we were buying [companies]. They were distressed. They were all out of money. When they came to us, they didn’t have the management capability to run their businesses. Often they were behind in paying bills, they had a lender who was upset. And so they were all sort of distressed, but there was asset value there.

These people actually got pretty far operating on a very thin amount of capitalization. Which made it tough to buy assets and you had to be disciplined not to overpay. So for that [first stage of M&A activity by Jushi], my background with distressed assets was really, really good to have.

Because with cannabis, you kind of start with a clean sheet of paper. Nobody gives you the playbook. Right? It’s a new industry. And there’s no playbook. If you’re in the global beer business, there’s a playbook for beer, right? There’s a playbook for foods or for what Procter & Gamble does or for Nestlé or whatever. There’s a playbook for that. They teach [those companies and industries] in business school. In fact, they’re part of the case studies.

But for us, there’s no playbook. So with distressed, it’s the same kind of thing. When you take a company over, you start out with a clean sheet of paper. You bring in new management, you change all the practices and all this other stuff.

And look how far you’ve come since the early days. You’re projected to be at over $300 million for 2022, right?

For 2022, our range right now is for $375 to $425 million of revenue. So the midpoint is about $400 million.

That’s quite a growth rate, right? Where is all that revenue going to come from? Just to contrast today’s Jushi to where you started from when you had only a few dispensaries and $10 million in sales in 2020.

We ended the year [2021] with about 28 dispensaries, 28 that we’ve operationalized with licenses. I could be off by a few here and there. You can get the numbers, but we have licenses for something like 38, so we can open another 10. We’re opening a bunch of those in 2022. A lot of those are in Virginia. We’re opening that fight for Virginia. We have one in Illinois, we have a license that we got through an affiliate and a couple in California. And then we’re doing deals, we’re buying some assets in Nevada.

At the end of last year, we bought a business in Massachusetts. That didn’t start getting added into our numbers until the end of the third quarter, the very end of the third quarter. This year, we’ll have a full year of that revenue. It’s a combination with some acquisition-driven revenue growth with Massachusetts, Nevada and other deals we hope to do, quite frankly, we hope to do some more deals to add to our portfolio for this year.

We will be opening new dispensaries and we have our grower-processors that we’re adding a ton of canopy to, which will add flower production in Pennsylvania and Virginia. These are very, very significant plant expansions.

Is most of that $400 million coming from dispensaries? How much comes from products you grow and manufacture?

I would say of that number—we can call it retail and wholesale, or wholesale selling to other retail dispensaries and retail selling your own product through your own dispensaries. Okay, with our grower-processor business, we sell a lot of it to ourselves. And that’s recognized from the investor standpoint as retail revenue. Right? But it’s kind of both.

So what’s the revenue mix?

Last year? We were about 90 to 95 percent retail. So 5 percent is wholesale [sales to third parties] last year. This year, it’ll be like two-thirds retail.

That’s going up pretty dramatically.

We did a big expansion of our processing operations. Where before we were adding through acquisitions, a lot of the new Jushi growth is coming from this intrinsic, organic growth that’s us building and expanding processors that we already own in Pennsylvania and Virginia.

You’re getting even more vertically integrated. Is that the path forward?

Yes, it is. Yeah. So the idea when we started this thing in 2018 was that we do everything ourselves, like a clean sheet of paper. What’s your strategy? Right? Why are you doing it that way? We don’t want to just do what everybody else does. We kind of watch what they do. But we decided that we thought retail licenses were more valuable [than they were being priced at] because of NIMBYism. We thought that licenses were not just going to keep multiplying in the states that we chose to be in, because of the “not-in-my-backyard” effect [keeping new license numbers low].

We thought, hey, that’s gonna be really, really sticky. You’re going to want those [licenses], and you want to have the retail when you have the wholesale business, so you can sell to yourself and makes it easier to start selling. So we said, you know, with our limited amount of seed capital, we should start putting it in retail first. We also thought retail was an easier business to run than the grow-processors.

We said, you know what, there are going to be a lot of grow-processors that screw it up. they’re under capitalized. You can just see it. It was it was fairly obvious to me, right? And so we said we can “backward-integrate”. In the case of Pennsylvania, which is our most important state, we backward-integrated by buying a whole grower-processor from a company that’s called Goodness Growth.

We backward-integrated into a plant that at the time was at 81,000 square feet. Our first expansion of this plant will add about 45,000 square feet to make it about 125,000 square feet. We bought some land around it and we also have have some more land that we’re under discussion to expand on that would take it to 350,000.

Can we talk about balance? How do you balance what the markets are telling you what to do versus what your investors might believe you should do?

That’s a great question, because when the Canadian bankers were taking the first cannabis companies public back in 2018 and 2019, there was a formula. At Jushi, we chose our own course and not the formula, because I understand deals, I understand risk-reward and I manage risk.

So here’s the formula we didn’t follow: You were supposed to buy in New York. You bought Florida and then you tried to get in as many states as you could. An easy state to get into was Massachusetts because of the license structure. But it’s not a great license, you only get three retail stores with it and there’s a cap of 100,000 square feet of canopy.

So the next part of the formula was then you do the analysis, like they did for mobile phones, how many people do you cover? You try to figure out the percentage of how many will use cannabis. And you conclude, here’s what your revenues might be in five years in some of these high-profile states.

We were like, well, that’s really stupid, because you have to invest so much money in these businesses to wait so long for profit. We were based in Florida so we had this dream of operating in Florida. But we didn’t like what we saw eventually in Florida’s regulatory structure.

So we passed on that formula. We went to Pennsylvania, not New York. And guess what, New York has been the worst big market of any of them today. They’ve had no flower sales until recently. They have a huge illicit adult market in the city. Everybody’s lost money there.

But we didn’t get pushed around in the back by the bankers. And you’re right, we had investors trying to get us to do that.

With cannabis, you kind of start with a clean sheet of paper. Nobody gives you the playbook. Right? It’s a new industry. If you’re in the global beer business, there’s a playbook for beer, right? Procter & Gamble, Nestlé—they teach them in business school, they’re part of the case studies.”

What’s your best-selling product as compared to the rest of the market? What’s your best performer as compared to peers?

A product that we are very good at historically is our vape product. We have had very competitive and popular and competitively priced vapes in the markets we’re in. We’re transitioning from CO2 to live resin. [The process for making live resin is] more highly explosive and it takes about a $1.5 million to get it right. And so we’re making that investment. A lot of regulatory approval is required.

Are their plans to add beverages to your edibles line?

No, I’m not a big fan of beverage. It’s a very small [portion of the industry]. I don’t understand this whole concept of drinking soda to get THC. We’ll leave that for somebody else.

If you had one “do over” during your tenure at Jushi, with the benefit of hindsight, with the benefit of all of the recent data as to the development of the U.S. cannabis industry, what decision would you have made differently and why?

So that’s interesting. I spend a lot of time self analyzing. I’m not easy on myself. I spend a lot of time trying to figure out what we can do better. Our mistakes have been small. We wasted a couple million dollars pursuing a CBD business, but we shut it down. We wasted a couple million dollars looking at Europe, and we’re in the process of punting that. So the mistakes have been small. We haven’t had a big capital mistake that we spent a lot of money on.

The thing probably that slowed us down in the beginning was … people. So I’m in distressed debt. I’m not afraid of anything, right? Took over companies, you fired the management. Often they stole from you. And you went in there, you rolled up your sleeves and it’s, “You want to bare knuckle fight? Okay, let’s bare knuckle fight.” I’m pretty good at that. “You want to get lawyers involved? Great, I got some of that, too.” “You want that kind of lawyer? I got that kind of lawyer.”

Whatever it is. So I wasn’t afraid of anything. These people that you got involved with, who were in this business 10 years ago or 15 years ago? A lot of these folks, they don’t live up to a deal. They don’t read contracts. They don’t understand contracts. If they do and read and understand them, they don’t care. They will never live up to a deal.

You can waste an awful lot of time with these people [getting] into a deal with them and unwinding it. And I think that’s been where my biggest errors have been: misunderstanding the counter-party risk in cannabis.

I’m laughing because I know exactly what you’re talking about!

We did not understand how difficult cannabis people are. We had to reset between 2017 and 2019. We wasted a lot of time doing that. Thankfully, we won the battle and we got some good assets out of it. But we wasted a lot of time.

Is there any decision you’ve made since founding Jushi of which you’re particularly proud? Or even surprised by how well the decision turned out?

Yeah. I mean, there are two decisions that I’m very proud of. One is the footprint we put into place in the beginning. Pennsylvania, Virginia, Illinois. We were three-for-three, but not only three for three — it was three-for-three with three home runs.

A display of Jushi products. PHOTO COURTESY OF JUSHI HOLDINGS

In other words, we didn’t mess around. We got it right. We avoided New York and Florida. That was huge. You know, if I [was in] Florida competing with Trulieve [with all their dispensaries], what fun is that? And nobody’s made money in New York. It’s been a shit show.

So avoiding those mistakes, right? And getting into Pennsylvania, Virginia, Illinois — that was by far the most strategic thing that that I’ve done.

Second is the people that we put in place. We put in an enormously good group of people, starting out with business development and legal, and then we had great HR. More recently, we’re building out IT and we have a new CFO, and we’re building out accounting.

And we keep improving on top. We had a great startup CFO but we had to upgrade as we became a large public company. We brought in a great COO out of Anheuser-Busch, we brought a great head of retail out of Urban Outfitters. Our head of IT is out of Southwest Airlines. I mean, how complex is IT at an airline? And [that same head of IT also worked for] a huge gaming company, meaning a casino. They have the security issues, cash issues, cameras, regulatory [issues], all this stuff. So [it was] a home run to acquire that person.

I’m going to end with a couple personal questions here. Do you use cannabis? And if so, how do you consume it?

Absolutely. I only do edibles. I got out of vaping with COVID. It’s a respiratory disease, so I didn’t want to [burden] my respiratory system. And once I got off of it, I never got back to it. But definitely I like the edibles and I’ve gotten to the point where I know how to do it. You know, the product you like, the dosage you like, taking it on an empty stomach to get the effect quicker.

Did you ever smoke a joint in high school or college?

I started smoking right when high school ended. Absolutely. That’s the only way you consumed it back then, was by smoking. There were no other form factors. Except for hash and you could you only find hash when you were in Amsterdam. Back then, the weed was terrible!

I had to smoke joints over the past four years, testing product occasionally. I haven’t in a while— again, because of COVID — but the product is so much better than when I was in high school. It’s just unbelievable. Back in the day when I smoked, the weed was untrimmed. You trimmed it yourself. It had seeds in it. They would pop, that would kind of get into your eye and you’d be like, “Oh, shit.“ It was kind of dangerous. The product was terrible.

It’s been fabulous to speak with you. Thank you, Jim.

TOM ZUBER is the Managing Partner of the law firm Zuber Lawler, which has been representing leading plant medicine companies for over 15 years.

SPONSORED VIDEO

Cannaconvo with Peter Su of Green Check Verified

Cannabis Last Week with Jon Purow interviews Peter Su of Green Check Verified. Peter Su is a Senior Vice President with Green Check Verified, the top cannabis banking compliance software/consultancy in the space. A 20+ year veteran of the banking industry, Peter serves on the Banking & Financial Services committee of the National Cannabis Industry Association. He chairs the Banking and Financial Services Committee for the NYCCIA & HVCIA. He is an official member of the Rolling Stone Cannabis Culture Council. And, he is on the board of the Asian Cannabis Roundtable, serving as treasurer.

You may like

Promoted Headlines

Ohio’s Move to Adult-Use Sales Could Be Record-Setting

Cannabis Investor Focus Shifts to Retail